COINVEST the world’s first decentralized investment trading market for cryptocurrencies.

Coinvest is the world’s first decentralized investment trading market for cryptocurrencies. Coinvest empowers anyone to virtually invest in individual or a curated index of cryptonized assets through one coin.

When And Why Was Coinvest Founded?

Frustrated with the complexity, fragmentation, and quality of cryptocurrency investment options available on the market, Coinvest was determined to democratize cryptocurrencies by creating tools enable consumers to seamlessly, securely, and safely invest and use cryptocurrencies.

Frustrated with the complexity, fragmentation, and quality of cryptocurrency investment options available on the market, Coinvest was determined to democratize cryptocurrencies by creating tools enable consumers to seamlessly, securely, and safely invest and use cryptocurrencies.

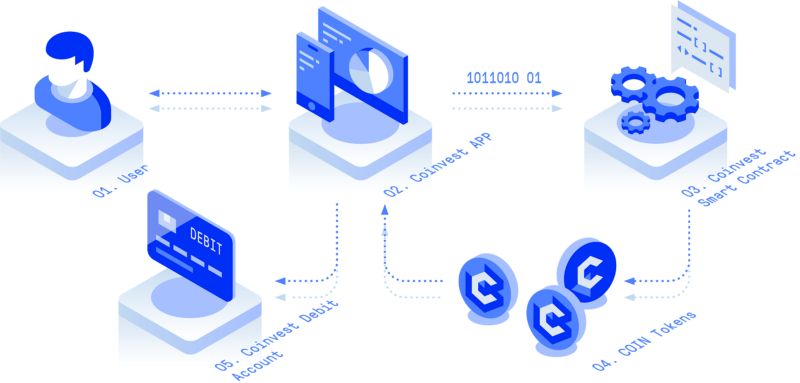

How Does Coinvest Work?

- Create a Coinvest Virtual Portfolio with Your Favorite Cryptocurrencies.

- Trade and Withdraw Investments (+ Profit) Directly with our Smart Contract.

- Easily spend cryptocurrencies using your debit card account.

What Are The Advantages Of Using Coinvest?

Simplicity.

Investing in cryptocurrencies today is an extremely difficult and a intensive process. Exchanges require KYC authorization which can take hours (if not days) to validate. Coinvest legally bypasses the KYC process as there is no exchange in fiat currency, assets, and as the Coinvest smart contract is the custodian of your deposited funds.

Convenience.

Securely storing cryptonized assets is imperative but not trivial. Some coins and tokens have different standards and require different wallets. As a consumer, you have to choose between different wallet options (such as hot, cold, paper, etc.) depending on your risk appetite. Storing assets yourself is feasible for some; however, complicated and risk hacking and user-error. With Coinvest, there is no storage of investment assets as all portfolios are completely digital.

Function.

Prices in cryptocurrency can be extremely volatile. Acquiring assets at the wrong price and time can be the difference in gains or losses. There are currently limited investment options that empower users to execute flexible buying options such as shorting and price limit orders. Coinvest is one of the first in the industry to offer this functionality.

Diversification.

Unlike current exchanges, Coinvest offers index funds containing a portfolio of cryptonized assets related to components such as market capitalization, industry, etc. The index funds enable users the ability to invest without individually and actively purchasing assets themselves. Meanwhile, providing broad market exposure, low operating expenses, and low portfolio turnover.

Autonomy.

There are currently no investment vehicles that enable investors to curate and invest in an index of cryptonized assets created by themselves. Current investment, index, and mutual funds are managed by third-party asset managers and offer no flexibility and control of the fund itself. Personal curated index funds on Coinvest empower users to control the assets, distribution percentages, rebalances, and withdrawals of their own individual fund.

Decentralization and Security.

Investing in cryptocurrencies require sending funds direct to an exchange or investment fund (which inherently creates centralization and high risk as they are the custodian of your funds). Coinvest does not accept any funds (fiat, cryptocurrency, etc.) or payments direct from users. User funds are held in escrow and controlled by the Coinvest autonomous bot (computer code) within a smart contract in the Coinvest protocol. Users can withdraw funds or close their positions at any time and obtain distributions automatically via the Coinvest smart contract. The Coinvest investment process requires no human involvement or interaction.

Backed Collateral.

All investments made through the Coinvest platform are backed by the cryptonized assets themselves. To ensure liquidity, Coinvest employs two reserves. (Please refer to the Coinvest Reserves section in this document for more detailed information) Investments will only be executed based upon available assets in the reserve, ensuring the security of all users. A percentage of company revenue is allocated for additional purchases to increase liquidity and scale the reserve in relation to growth.

author: husen12

Comments

Post a Comment